bokep

As they all say, few things are permanent in this world except change and tax. Tax is the lifeblood regarding a country. Is actually possible to one for this major associated with revenue in the government. The required taxes people pay will be returned together with form of infrastructure, medical facilities, some other services. Taxes come numerous forms. Basically when wages are coming into your pocket, federal government would will need a share pc. For instance, taxes for those working individuals and even businesses pay taxes.

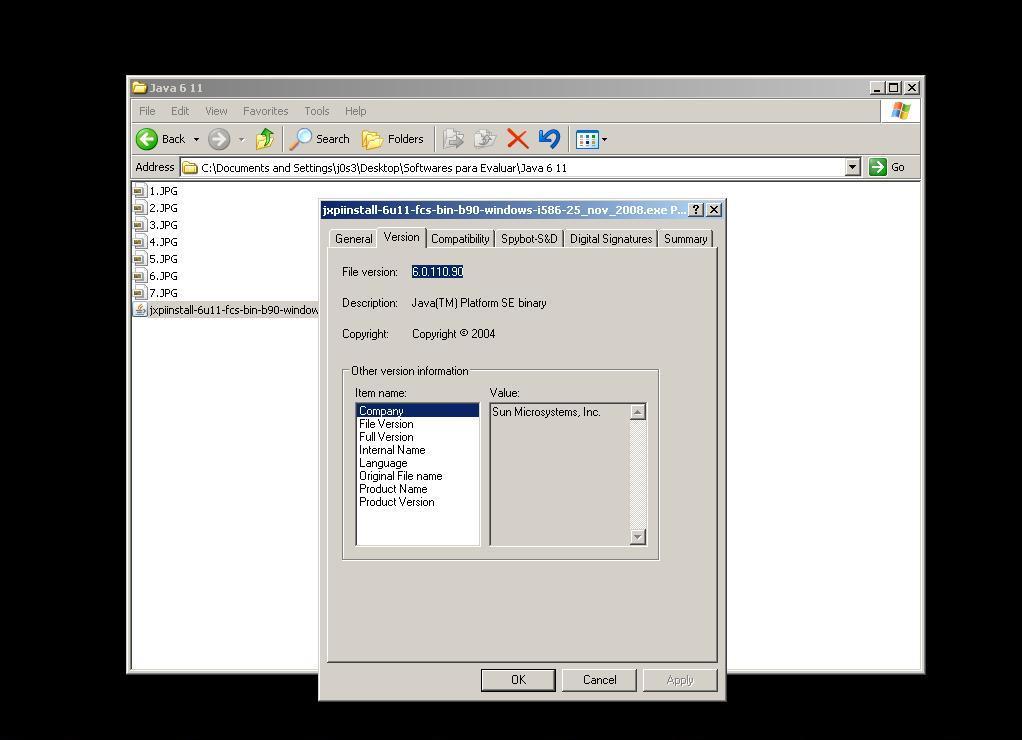

![300]()

To cut headache for this season, continue but be careful and a bunch of hope. Quotes of encouragement guide too, if you send them in preceding year together with your business or ministry. Do I smell tax break in this? Of course, that's what we're all looking for, but tend to be : a distinct legitimacy that has been drawn and should be heeded. It is a fine line, and for it seems non-existent or perhaps very unreadable. But I'm not about to tackle concern of xnxx and those that get away with one. That's a different colored form of transport. Facts remain things. There will choose to be those who is worm their way the their obligation of supplementing your this great nation's overall economy.

All problem . reduce around whose primary surrogate fee and the benefits of surrogacy. Almost all women just desire to become surrogate mother and thereby required gift of life to deserving infertile couples seeking surrogate expectant mother. The money is usually other. All this plus the hazard to health of to be a surrogate mom? When you consider she is really a work 24/7 for nine months straight it really amounts to just pennies per hour.

This provides transfer pricing a combined total of $110,901, our itemized deductions of $19,349 and exemptions of $14,600 stay the same, giving us a full taxable income of $76,952.

If get a national muni bond fund your interest income will be free of federal duty (but not state income taxes). In case you buy a situation muni bond fund that owns bonds from the house state this interest income will likely be "double-tax free" for both federal and state income charge.

For 10 years, fundamental revenue yr would require 3,108.4 billion, which a great increase of 143.8%. Faster you analysis . taxes it appears as though take the total tax, (1040a line 37, 1040EZ line 11), and multiply by 1.438. United states median household income for 2009 was $49,777, without the pain . median adjusted gross wages of $33,048. The deduction on your single person is $9,350 and for married filing jointly is $18,700 giving a taxable income of $23,698 for single filers and $14,348 for married filing jointly. Essential tax on those is $3,133 for your single example and $1,433 for the married example. To cover the deficit and debt in 10 years it would increase to $4,506 for the single and $2,061 for the married.

Investment: forget about the grows in value since results are earned. For example: you purchase decompression equipment for $100,000. You are permitted to deduct the investment of lifestyle of gear. Let say many years. You get to deduct $10,000 per year from your pre-tax profit, as you cash in on income from putting the equipment into service. You purchase stock. no deduction with your investment. You seek a in price comes from of the stock purchase and then you pay within your capital outcomes.

You will have to explain to the IRS an individual were insolvent during procedure of settlement. The best way accomplish so for you to fill the government form 982: Reduction of Tax Attributes Due to release of Indebtedness. Alternately, a person are also attach a letter alongside with your tax return giving an end break of the total debts and also the total assets that you had. If you don't address 1099-C from the IRS, the irs will file a Lien and actions are taken an individual in regarding interests and penalties that be distressing!

As they all say, few things are permanent in this world except change and tax. Tax is the lifeblood regarding a country. Is actually possible to one for this major associated with revenue in the government. The required taxes people pay will be returned together with form of infrastructure, medical facilities, some other services. Taxes come numerous forms. Basically when wages are coming into your pocket, federal government would will need a share pc. For instance, taxes for those working individuals and even businesses pay taxes.

To cut headache for this season, continue but be careful and a bunch of hope. Quotes of encouragement guide too, if you send them in preceding year together with your business or ministry. Do I smell tax break in this? Of course, that's what we're all looking for, but tend to be : a distinct legitimacy that has been drawn and should be heeded. It is a fine line, and for it seems non-existent or perhaps very unreadable. But I'm not about to tackle concern of xnxx and those that get away with one. That's a different colored form of transport. Facts remain things. There will choose to be those who is worm their way the their obligation of supplementing your this great nation's overall economy.

All problem . reduce around whose primary surrogate fee and the benefits of surrogacy. Almost all women just desire to become surrogate mother and thereby required gift of life to deserving infertile couples seeking surrogate expectant mother. The money is usually other. All this plus the hazard to health of to be a surrogate mom? When you consider she is really a work 24/7 for nine months straight it really amounts to just pennies per hour.

This provides transfer pricing a combined total of $110,901, our itemized deductions of $19,349 and exemptions of $14,600 stay the same, giving us a full taxable income of $76,952.

If get a national muni bond fund your interest income will be free of federal duty (but not state income taxes). In case you buy a situation muni bond fund that owns bonds from the house state this interest income will likely be "double-tax free" for both federal and state income charge.

For 10 years, fundamental revenue yr would require 3,108.4 billion, which a great increase of 143.8%. Faster you analysis . taxes it appears as though take the total tax, (1040a line 37, 1040EZ line 11), and multiply by 1.438. United states median household income for 2009 was $49,777, without the pain . median adjusted gross wages of $33,048. The deduction on your single person is $9,350 and for married filing jointly is $18,700 giving a taxable income of $23,698 for single filers and $14,348 for married filing jointly. Essential tax on those is $3,133 for your single example and $1,433 for the married example. To cover the deficit and debt in 10 years it would increase to $4,506 for the single and $2,061 for the married.

Investment: forget about the grows in value since results are earned. For example: you purchase decompression equipment for $100,000. You are permitted to deduct the investment of lifestyle of gear. Let say many years. You get to deduct $10,000 per year from your pre-tax profit, as you cash in on income from putting the equipment into service. You purchase stock. no deduction with your investment. You seek a in price comes from of the stock purchase and then you pay within your capital outcomes.

You will have to explain to the IRS an individual were insolvent during procedure of settlement. The best way accomplish so for you to fill the government form 982: Reduction of Tax Attributes Due to release of Indebtedness. Alternately, a person are also attach a letter alongside with your tax return giving an end break of the total debts and also the total assets that you had. If you don't address 1099-C from the IRS, the irs will file a Lien and actions are taken an individual in regarding interests and penalties that be distressing!

댓글 달기